You can read more in our guide to the deemed salary and the treatment of expenses here.Are you an independent contractor? Learn what expenses are tax deductible and what tax savings you are eligible for during tax time.ĭeduct expenses related to your home office, such as: If you’re in any doubt, ask your accountant for advice. You should always ensure that any expenses you claim are genuine and were incurred solely for business purposes, and you should always keep receipts for any expenses you claim. You may also wish to refer to the IR35 expenses FAQ on the HMRC website. You can find out more about the ‘5% allowance’ in our dedicated article, IR35 deemed payment and the treatment of expenses. This expenses allowance is a flat rate deduction of 5% of the gross fees receivable for any relevant contracts. If you work for a ‘small company’ end-client, you can still claim the 5% allowance if your contract work is caught by IR35. The rules were extended to private sector contractors from April 2021 onwards. It is worth noting that, from the introduction of the ‘Off Payroll’ rules in April 2017, if you are caught by IR35 and work in the public sector, the 5% is no longer available to you. If you are a limited company contractor, and your contract work is caught by the IR35 rules, you are provided with a fixed ‘5% allowance’ which is intended to cover administrative expenses associated with running a business.

CONTRACTOR EXPENSES AND TAX DEDUCTIONS PROFESSIONAL

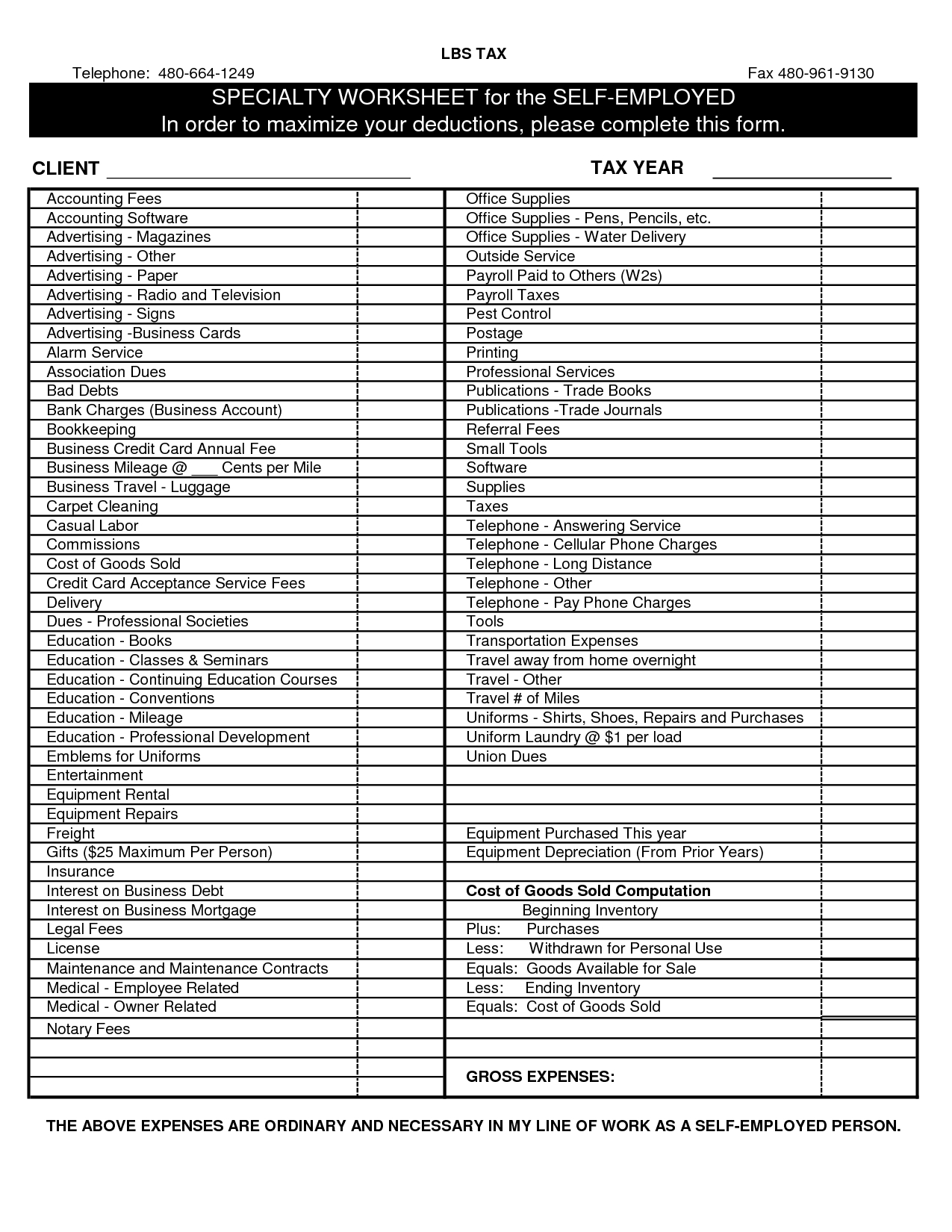

Subscriptions to eligible professional organisations (on HMRC’s prescribed list).Subscriptions to professional magazines.You can pay for life insurance via your company, as long as it’s a relevant life policy – this is very tax efficient.You can reclaim the cost of parking, all other types of transport, and any congestion charge fees. Find out more about mileage expenses and be aware of the 24-month rule. You can claim 45p/mile for the first 10,000 miles (and 25p thereafter) if you use your own car for business reasons. Or, just business phone calls if itemised on a personal bill. Cost of phone and broadband – if the contracts are in the company name.Business insurance, such as professional indemnity insurance and business liability cover.Any Employers’ National Insurance payable on salaries.Your salary (and spouse, if applicable).Professional fees, such as accountancy fees, or the costs of using a solicitor for business purposes.Here are some of the typical expenses your company is allowed to claim back against its Corporation Tax bill: Typical contractor expenses There are many ‘grey areas’ – for example, if you claim for something that has a ‘dual-purpose’ (personal and business use), so you should always check with your accountant if you are unsure about the validity of your expense claims. It doesn’t matter how they were paid for, as long as they are legitimate in nature. You may have paid these out of your own pocket – and reclaimed them from your company, or the company may have paid them directly. The golden rule is that you can only claim for business expenses you incur wholly and exclusively in the course of your contracting work.

Here we look at the most typical contractor expenses, and the rules you must follow to ensure any claims you make are legitimate. If you are a professional contractor, you can claim back a wide variety of expenses against your limited company’s tax bill.

0 kommentar(er)

0 kommentar(er)